Filing Your FinCEN Beneficial Ownership Information Report

Everything Small Business Owners Need to Know about FinCEN BOI

Starting January 1, 2024, many small businesses, including corporations and LLCs, must file beneficial ownership information with FinCEN under the Corporate Transparency Act (CTA)

Key Details:

Filing, which is a one-time report (updated only if ownership details change) should take less than 15 minutes.

Effective Date: Starts January 1, 2024, for most small businesses under the Corporate Transparency Act (CTA).

Who Must File: Small corporations, LLCs, and similar entities with:

20 or fewer full-time employees

Gross receipts or sales of $5 million or less

Exemptions: 23 categories, including banks, insurance companies, large operating companies, and tax-exempt entities.

What to Report:

Company info (name, address, tax ID)

Beneficial owner info (name, address, ID numbers)

Deadlines:

Existing companies: File by January 1, 2025

New companies (2024): File within 90 days of creation

New companies (2025 onward): File within 30 days

Filing Method: Secure electronic submission via FinCEN starting January 1, 2024. File Your BOI Report Here

Penalties: Daily fines and criminal penalties for non-compliance up to $500/day.

Legal Challenge: Pending court case may affect future enforcement; consult legal counsel if unsure.

Overview

Starting January 1, 2024, many small businesses in the U.S. will need to comply with a new filing requirement from the Financial Crimes Enforcement Network (FinCEN) under the Corporate Transparency Act (CTA). Part of a broader push to curb financial crimes, the CTA mandates that businesses file information about their beneficial owners — those who ultimately control or benefit from the company. This requirement, enacted as part of the 2021 National Defense Authorization Act, is designed to increase transparency and help prevent activities like money laundering, terrorism financing, and tax evasion.

For small businesses, understanding the FinCEN Beneficial Ownership Information (BOI) filing requirements is crucial, as it brings new responsibilities, reporting deadlines, and the potential for penalties if not followed. While many large and publicly traded companies are exempt from this regulation, most small corporations, LLCs, and other similar entities will need to comply. The CTA aims to create a national registry of beneficial ownership data, which will make it harder for bad actors to hide behind shell companies, leveling the playing field and promoting greater integrity across U.S. business practices.

Summary of FinCEN Benneficial Ownership Interest Reporting (BOI) Update (27-Dec-2024)

Key Update: Filing Requirement Temporarily Stayed

Due to a federal court order, reporting companies are not currently required to file Beneficial Ownership Information (BOI) reports with FinCEN and will not face penalties for non-compliance while the order remains in effect. Filing BOI reports is voluntary during this period.

Background

The Corporate Transparency Act (CTA) aims to prevent illicit activities like money laundering, terrorist financing, and drug trafficking while promoting fairness for small businesses.

On December 3, 2024, a federal court issued a nationwide preliminary injunction in Texas Top Cop Shop, Inc. v. Garland, halting BOI reporting requirements.

The Department of Justice (DOJ) appealed the injunction and obtained a temporary stay on December 23, 2024, which allowed the reporting deadline to be extended.

However, on December 26, 2024, a new court panel vacated the stay, reinstating the injunction and suspending BOI filing obligations.

Current Status

While the legal dispute continues, reporting companies are not required to submit BOI reports, but voluntary filings are still accepted by FinCEN. The DOJ and the Department of Treasury maintain their stance that the CTA is constitutional and are pursuing further appeals.

Source: https://www.fincen.gov/boi

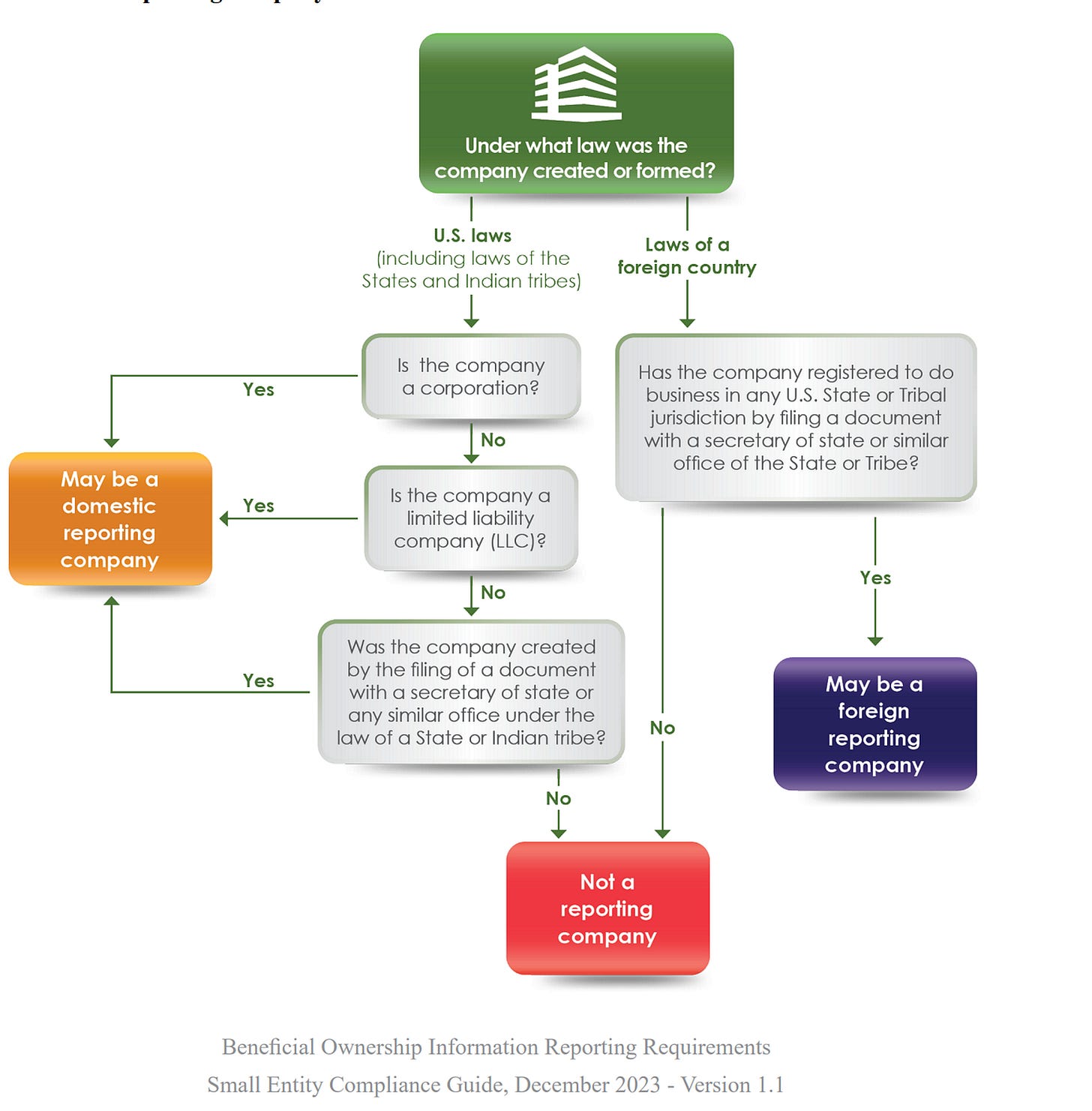

Who Needs to File the FinCEN BOI?

Targeted Entities: Small corporations, LLCs, and similar entities

Criteria for Filing:

20 or fewer full-time employees

$5 million or less in gross receipts/sales

The new FinCEN BOI filing requirement applies primarily to small, privately held businesses, including corporations, limited liability companies (LLCs), and similar entities. These businesses often have simpler structures and fewer regulatory oversight obligations, making them the main focus of the Corporate Transparency Act’s (CTA) drive for enhanced transparency.

Targeted Entities

Small corporations, LLCs, and other similar business structures are required to file under the CTA if they meet specific criteria. This also includes some foreign entities conducting business in the U.S. that register here, as well as entities with limited oversight that could otherwise operate anonymously.

Criteria for Filing

To determine if your business needs to file, verify if it meets the following criteria:

20 or Fewer Full-Time Employees: Only businesses with 20 or fewer full-time employees, as reported on their last federal income tax return, are included.

$5 Million or Less in Gross Receipts/Sales: Entities with annual gross receipts or sales of $5 million or less on their last federal income tax return are within the filing scope.

Example Scenarios

Local Retail Shop: A family-owned boutique with 10 employees and annual sales of $2 million qualifies for the BOI filing requirement.

Small Consulting Firm: An LLC offering consulting services with five employees and annual revenue of $800,000 must file as it falls under both employee and revenue thresholds.

Single-Member LLC: A one-person-owned real estate holding LLC that has no employees but reports modest income also meets the criteria for filing.

By meeting these criteria, many small businesses are likely required to file, while larger businesses and those with greater regulatory oversight often fall under exemption categories.

Exemptions to BOI Reporting

While the BOI filing requirement applies to many small businesses, certain entities are exempt from reporting due to their regulatory oversight, size, or specific industry characteristics. Understanding these exemptions is critical for businesses to determine whether they need to submit a report.

List of Exempt Entities

The CTA outlines 23 specific categories of entities that are exempt from BOI reporting, as they are generally subject to existing regulatory scrutiny or oversight. These exempt categories include:

Securities reporting issuers

Governmental authorities

Banks

Credit unions

Depository institution holding companies

Money services businesses

Brokers or dealers in securities

Securities exchanges and clearing agencies

Other Exchange Act-registered entities

Investment companies and advisers

Venture capital fund advisers

Insurance companies

State-licensed insurance producers

Commodity Exchange Act-registered entities

Accounting firms

Public utilities

Financial market utilities

Pooled investment vehicles

Tax-exempt entities

Entities assisting tax-exempt organizations

Large operating companies (with specific criteria)

Subsidiaries of certain exempt entities

Inactive entities

Each of these categories has specific qualifying criteria, and businesses should consult page 11 of the FinCEN Guide if they think they might meet one of these exemptions and need more information.

Specific Exemptions for Title Insurance and Related Entities

For those in the title insurance industry, Exemptions #12 and #13 may apply:

Exemption #12: Insurance Companies — An entity qualifies for exemption if it meets the definition of an “insurance company” under Section 2 of the Investment Company Act of 1940, indicating regulatory compliance and oversight.

Exemption #13: State-Licensed Insurance Producers — An insurance producer licensed at the state level qualifies if:

The entity is state-authorized and regulated by the state’s insurance commissioner or equivalent official.

It operates from a physical office in the U.S. that it owns or leases, distinct from any unaffiliated business location.

These exemptions mean that many title insurance companies and licensed agents won’t need to file under the BOI requirement.

Large Operating Company Exemption

The “Large Operating Company” exemption applies to entities meeting all of the following criteria:

Employee Requirement: Employs more than 20 full-time employees in the U.S.

Revenue Threshold: Reports gross receipts or sales over $5 million on its most recent federal income tax return, excluding any income from foreign sources.

Physical Office: Has a physical office within the U.S. where business is regularly conducted.

This exemption is meant to exclude larger, more established businesses that are already subject to various transparency regulations. For companies hoping to qualify, it’s essential to meet all criteria consistently, as falling below any threshold would re-trigger the BOI filing requirement.

Businesses uncertain about their eligibility for these exemptions should refer to the detailed FinCEN compliance guide or consult a legal advisor.

Required Information for Filing

For the Company: Legal name, DBA name, address, jurisdiction, and tax ID number

For Beneficial Owners and Company Applicants: Full name, date of birth, address, ID numbers (U.S. or foreign)

FinCEN Identifier: can be used as an alternative if available

To comply with the BOI reporting requirement, companies need to provide detailed information about the business itself as well as its beneficial owners and company applicants. This information ensures that FinCEN can accurately track and verify beneficial ownership.

Filing, which is a one-time report (updated only if ownership details change) should take less than 15 minutes.

For the Company

Each reporting company must submit:

Legal Name: The official name of the business as registered.

DBA Name: Any trade name or “doing business as” name, if applicable.

Address: The principal business address in the U.S. or, if the business is foreign, the primary U.S. location where it operates.

Jurisdiction of Formation: The state, tribal, or foreign jurisdiction where the company was formed; for foreign entities, also include the U.S. jurisdiction of first registration.

Tax Identification Number: The IRS-issued Taxpayer Identification Number (TIN), such as the Employer Identification Number (EIN); foreign companies without a TIN should provide a foreign tax ID and issuing jurisdiction.

For Beneficial Owners and Company Applicants

For each individual identified as a beneficial owner or applicant (such as an individual who filed to create the entity), the following details are required:

Full Legal Name: The individual’s complete legal name.

Date of Birth: The individual’s date of birth.

Current Address: For beneficial owners, use the residential address; for applicants, use their business address.

Unique Identifying Number and Issuing Jurisdiction: A valid identification document, such as a U.S. passport, state driver’s license, tribal ID, or foreign passport, along with the issuing jurisdiction.

Q. If one spouse has an ownership interest in a reporting company, is the other spouse also considered a beneficial owner if the reporting company is created or registered in a community property state?

A. Possibly. Whether State community property laws affect a beneficial ownership determination will depend upon the specific consequences of applying applicable State law. If, applying community property State law, both spouses own or control at least 25 percent of the ownership interests of a reporting company, then both spouses should be reported to FinCEN as beneficial owners unless an exception applies.

Q. Are reporting companies required to report the addresses of beneficial owners or company applicants that participate in an Address Confidentiality Program (ACP)?

A. FinCEN is mindful of the critical privacy interests protected by ACPs. Reporting companies that are required to report a beneficial owner or company applicant registered with a State’s ACP should report to FinCEN the ACP address that the State provided to the individual. As a best practice, individuals registered with a State ACP may consider retaining documentation to demonstrate that they participate in an ACP.

FinCEN Identifier

If available, a FinCEN identifier can serve as a substitute for the above information. Individuals or companies can apply for this unique identifier directly with FinCEN, providing an alternative means to submit required details without disclosing personal identifiers. The FinCEN identifier is especially helpful for those who may need to file multiple reports across different entities or roles.

Refer to Chapter 3 of the FinCen BOI Small Compliance Guide for specifics on whether your company needs to report information about company applicants.

Important FinCEN BOI Filing Deadlines and Compliance Dates

Effective Date: January 1, 2024, for first filings

Deadlines:

Existing companies (by January 1, 2025)

New companies in 2024 (within 90 days of creation)

New companies in 2025 and beyond (within 30 days of creation)

Status Change Requirement: Reporting within 30 days if losing exemption

Effective Date

The BOI reporting requirement takes effect on January 1, 2024, when FinCEN will begin accepting Beneficial Ownership Information (BOI) filings.

Filing Deadlines

Existing Companies: Businesses that were already in existence as of January 1, 2024, must file their initial BOI report by January 1, 2025.

New Companies Created in 2024: Entities formed or registered between January 1, 2024, and December 31, 2024, have 90 calendar days from the date they receive actual or public notice of their creation or registration to submit their BOI report.

New Companies Formed on or After January 1, 2025: These companies must file within 30 calendar days from the receipt of actual or public notice of their formation or registration.

Status Change Requirement

If a company previously qualified for an exemption but later loses this status (e.g., changes in business operations or ownership), it must file a BOI report within 30 calendar days of losing the exemption to remain compliant with the reporting regulations.

Timely compliance with these deadlines is critical to avoid penalties.

Alert: FinCEN has issued five Notices extending the filing deadlines to submit BOI reports for certain reporting companies in response to Hurricane Milton, Hurricane Helene, Hurricane Debby, Hurricane Beryl, and Hurricane Francine.

To qualify, a reporting company must have a BOI reporting deadline falling within the period beginning one day before the date the specified disaster began — as indicated by the Federal Emergency Management Agency (FEMA) — and ending 90 days after that date. (Where multiple disasters with different starting dates are related to the same storm, FinCEN used the earliest of these dates.) A reporting company also must be located in an area that is designated both by FEMA as qualifying for individual or public assistance and by the Internal Revenue Service as eligible for tax filing relief. Please refer to the applicable Notice for specific information.

NOTICE: FinCEN Provides BOI Reporting Relief to Victims of Hurricane Beryl

NOTICE: FinCEN Provides BOI Reporting Relief to Victims of Hurricane Debby

NOTICE: FinCEN Provides BOI Reporting Relief to Victims of Hurricane Francine

NOTICE: FinCEN Provides BOI Reporting Relief to Victims of Hurricane Helene

NOTICE: FinCEN Provides BOI Reporting Relief to Victims of Hurricane Milton

How to File the FinCEN Beneficial Ownership Information (BOI) Report

Filing Method

To meet the BOI reporting requirement, companies must submit their information electronically through FinCEN’s secure online filing system, which will be available starting January 1, 2024. This online platform will provide a straightforward, secure way for companies to submit their Beneficial Ownership Information (BOI) and will require users to create an account to access and complete the filing.

The system will walk you through the data fields section by section. It is well designed and easy to use.

Instructions and Support

FinCEN will publish detailed instructions and technical guidance on how to file the BOI report, available on their website at www.fincen.gov/boi. These resources will include step-by-step instructions, frequently asked questions, and troubleshooting support for common filing issues. For companies experiencing technical issues or needing additional assistance with the filing process, FinCEN provides support through its contact page at www.fincen.gov/contact, where users can reach out for direct help.

Ensuring all required details are accurate and timely can help avoid penalties or follow-up compliance actions.

FAQs

Is there a filing fee?

No

Do I need an attorney, accountant or other service provider to do this for me?

No, honestly, it’s very basic information and very straightforward. Any business owner can file this report.

Penalties for Non-Compliance

Financial Penalties: Daily civil fines for failure to file after 90 days post-formation

Criminal Penalties: Potential consequences and need for compliance

Failing to comply with the BOI filing requirement can result in significant financial and legal repercussions.

Financial Penalties

For businesses that fail to file their BOI report within 90 days of their formation or registration date, FinCEN may impose civil penalties. These fines accrue daily and can quickly add up, placing a financial burden on non-compliant companies. Each day that the report remains unfiled after the initial deadline increases the potential penalty total.

$500/day civil penalty after 90 days post-entity formation

criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000.

Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.

Criminal Penalties

Beyond civil fines, failure to comply with the BOI reporting requirement may also lead to criminal charges, especially in cases where non-compliance is deemed willful or intentional. Criminal penalties may include substantial fines and, in severe cases, imprisonment for those responsible. Given these serious consequences, maintaining compliance with BOI requirements is essential for businesses, and consulting with legal or compliance professionals is recommended to ensure timely and accurate filing.

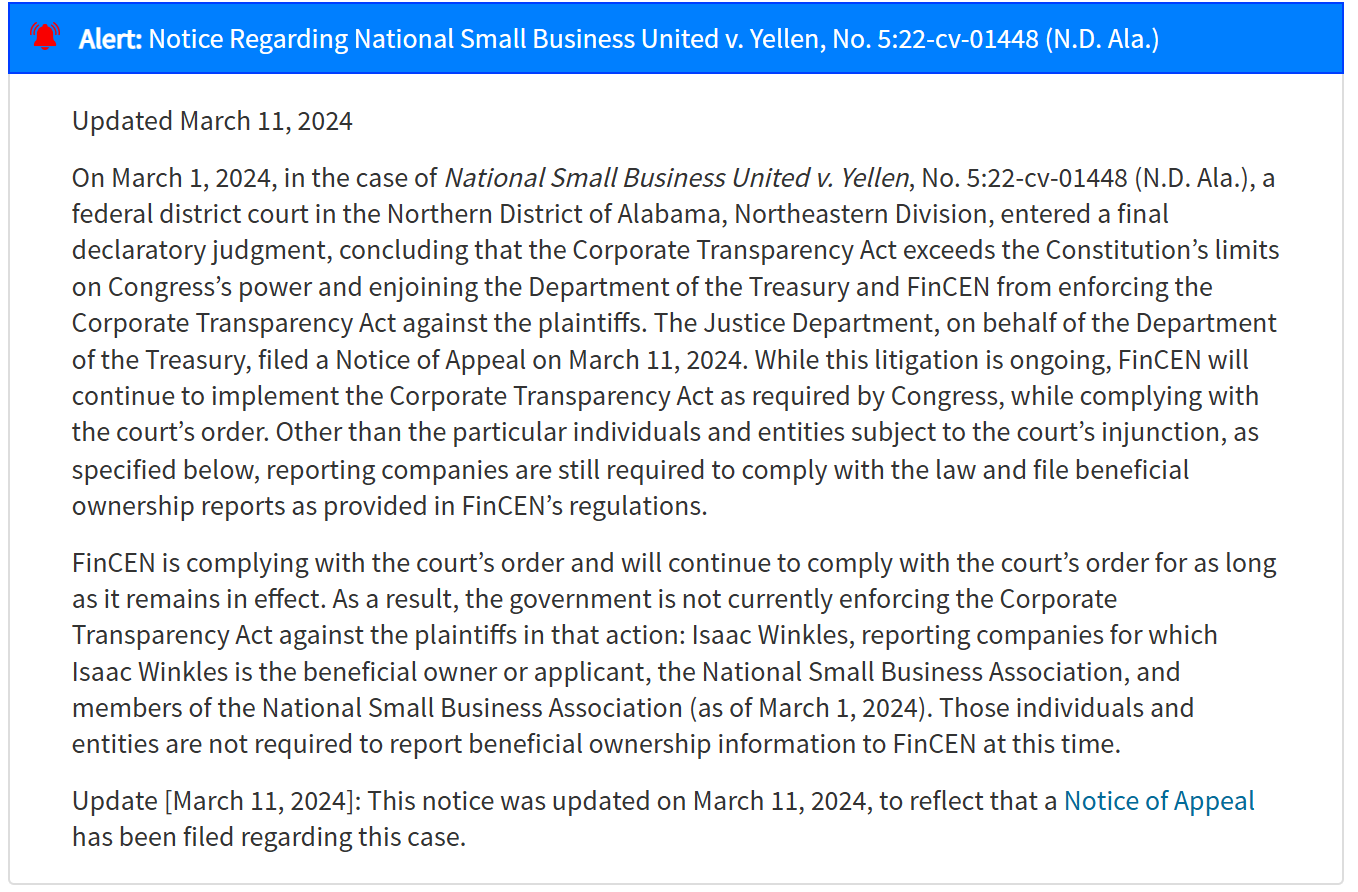

Ongoing Legal Challenge and Considerations

Overview of Court Case: The Corporate Transparency Act (CTA) faces a significant legal challenge in the case National Small Business United v. Janet Yellen, where a federal district court in Alabama ruled the CTA unconstitutional on March 1, 2024. This ruling currently applies only to the plaintiff, National Small Business United v. Janet Yellen

Current Status: For now, compliance with the CTA is still required by all businesses, except for the plaintiffs in the Alabama case

Guidance: Due to the ongoing legal challenges and potential changes in the law, it is essential for small business owners to stay informed and consult legal counsel to ensure compliance with the CTA as it currently stands.

Overview of Court Case

The Corporate Transparency Act (CTA) faces a significant legal challenge in the case National Small Business United v. Janet Yellen, where a federal district court in Alabama ruled the CTA unconstitutional on March 1, 2024. The plaintiffs argue that the CTA violates several constitutional amendments and oversteps federal powers by intruding on areas traditionally governed by state law, particularly corporate governance. The Alabama court found that the CTA lacked a constitutional basis, specifically citing that it exceeded Congress’s authority and did not align with any enumerated powers in the Constitution. This ruling currently applies only to the plaintiff, National Small Business United v. Janet Yellen.

The case is now on appeal before the 11th Circuit Court, which heard arguments on September 26, 2024. If the Circuit Court upholds the Alabama court’s ruling, the U.S. Treasury Department is likely to escalate the case to the U.S. Supreme Court. Additionally, several other lawsuits challenging the CTA have emerged in courts across the country, increasing the potential for a “split” in circuit court decisions, which would necessitate a final Supreme Court ruling.

Current Status

For now, compliance with the CTA is still required by all businesses, except for the plaintiffs in the Alabama case. Over 36 million U.S. businesses must file their Beneficial Ownership Information (BOI) by the end of 2024 or risk penalties. While some online misinformation may suggest that the Alabama ruling invalidates the requirement broadly, the exemption currently applies only to the specific plaintiffs in that case, not to all businesses or even those within Alabama. The government continues to enforce BOI requirements for most businesses, given the CTA’s objective to increase transparency and reduce financial crime risks.

Guidance

Due to the ongoing legal challenges and potential changes in the law, it is essential for small business owners to stay informed and consult legal counsel to ensure compliance with the CTA as it currently stands. Legal professionals can help business owners navigate these requirements, prevent costly errors, and stay prepared for potential changes stemming from future court rulings. Proactively engaging in compliance helps safeguard against steep penalties, and for those uncertain about their reporting obligations, consulting a legal expert is advisable to develop a compliance plan that adapts to any future shifts in BOI reporting requirements.

Resources for More Detailed Information about the FinCen BOI Reporting

FinCen Beneficial Ownership Information site

FinCen BOI Small Compliance Guide

The Library 📖 at the Business Witch Academy is a reader-supported publication. Knowledge is my product. Like you, I have bills to pay and loved ones to care for. If you ever have, or would, pay a college or university for sharing knowledge with you, and you find value in my writing, please consider a paid subscription so that I can continue with my work.

Stay Magical,

Cheryl

🛒 Shop BWA | 🌈 Shop Ophelia's Bazaar | 💸 Become a Sponsor | 🔔 Subscribe

DISCLAIMER

Many of the people and businesses I feature are ones that I've met in the course living my life and running my businesses. I feature them when I feel they have something my readers may be interested in hearing about.

Some outbound links may financially benefit me through affiliate programs or sponsorships, but frequently they don't. Any affiliate relationship doesn’t influence my opinion, and I would never endorse people, programs, products, or services I didn’t use, approve of or feel familiar with. So If you use it, I may get compensated — but there’s no additional cost to you.